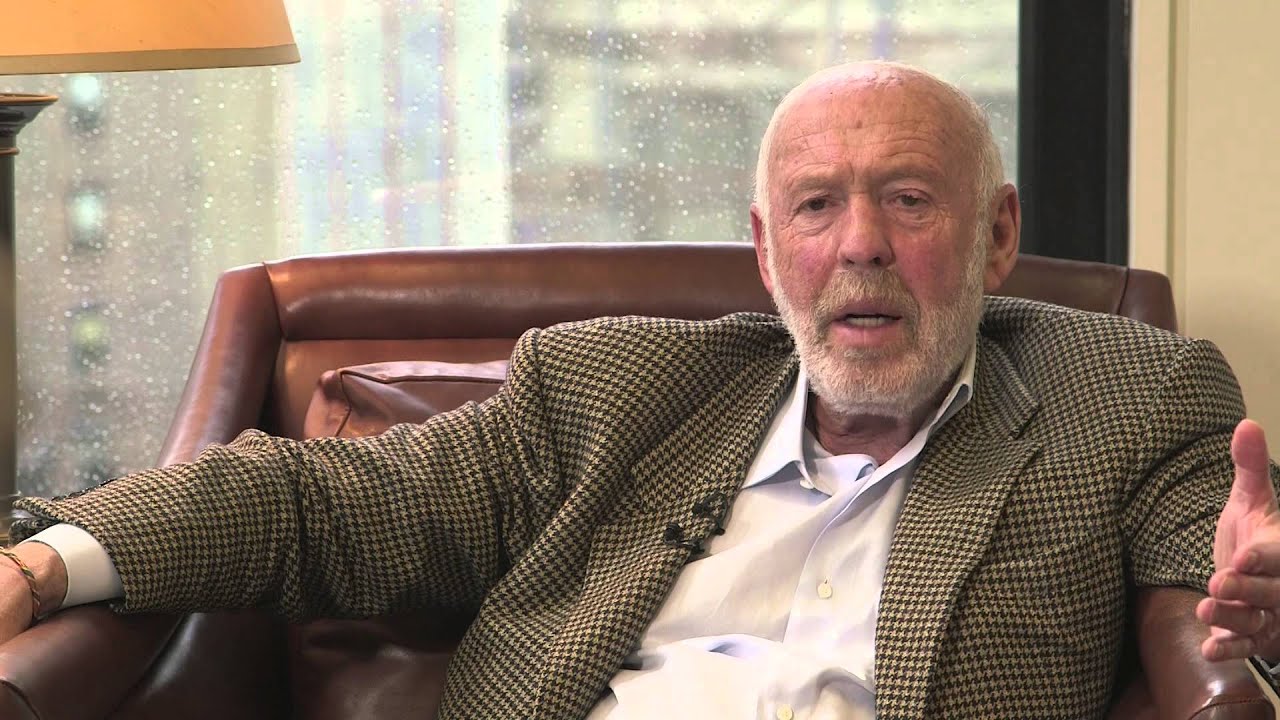

Unveiling James Simons' Net Worth: Discoveries And Insights

James Simons is an American mathematician, hedge fund manager, and philanthropist. As of 2023, his net worth is estimated to be around $28 billion, making him one of the richest people in the world. Simons is the founder and former CEO of Renaissance Technologies, a hedge fund that has consistently outperformed the market since its inception in 1982.

Simons' success in the financial world is due in part to his innovative use of mathematical models and data analysis. He is a pioneer in the field of quantitative investing, which uses statistical and mathematical techniques to identify undervalued assets. Simons' hedge fund has been able to generate high returns by identifying mispriced assets and taking advantage of market inefficiencies.

In addition to his financial success, Simons is also a noted philanthropist. He has donated hundreds of millions of dollars to various causes, including education, scientific research, and medical research. Simons is also a major supporter of the arts and has donated to museums and other cultural institutions.

James Simons Net Worth

James Simons is an American mathematician, hedge fund manager, and philanthropist. As of 2023, his net worth is estimated to be around $28 billion, making him one of the richest people in the world. Simons is the founder and former CEO of Renaissance Technologies, a hedge fund that has consistently outperformed the market since its inception in 1982.

- Quantitative investing: Simons is a pioneer in the field of quantitative investing, which uses statistical and mathematical techniques to identify undervalued assets.

- Hedge fund performance: Renaissance Technologies has been able to generate high returns by identifying mispriced assets and taking advantage of market inefficiencies.

- Philanthropy: Simons is a noted philanthropist who has donated hundreds of millions of dollars to various causes, including education, scientific research, and medical research.

- Mathematical models: Simons' success in the financial world is due in part to his innovative use of mathematical models and data analysis.

- Market inefficiencies: Simons' hedge fund has been able to generate high returns by identifying and exploiting market inefficiencies.

- Wealth management: Simons is a successful wealth manager who has been able to grow his net worth to $28 billion.

- Financial success: Simons' success in the financial world has made him one of the richest people in the world.

- Global impact: Simons' philanthropy has had a global impact, supporting important causes in education, science, and medicine.

These key aspects highlight the various dimensions of James Simons' net worth, from his innovative investment strategies to his philanthropic endeavors. His success in the financial world is a testament to his mathematical skills and his ability to identify and exploit market inefficiencies. Simons' philanthropy has had a major impact on the world, supporting important causes in education, science, and medicine.

Quantitative investing

Quantitative investing is a major reason behind James Simons' net worth of $28 billion. Simons is a pioneer in this field, which uses statistical and mathematical techniques to identify undervalued assets. This approach has allowed Renaissance Technologies, the hedge fund founded by Simons, to consistently outperform the market since its inception in 1982.

- Data analysis: Quantitative investing relies heavily on data analysis to identify patterns and trends in the market. Simons and his team at Renaissance Technologies have developed sophisticated algorithms and models to analyze vast amounts of data, which allows them to identify undervalued assets that are likely to appreciate in value.

- Risk management: Quantitative investing also involves sophisticated risk management techniques. Simons and his team use mathematical models to assess and manage risk, which allows them to protect their capital and maximize returns.

- High returns: Quantitative investing has allowed Renaissance Technologies to generate high returns for its investors. The fund has consistently outperformed the market, generating average annual returns of over 30% since its inception.

Overall, quantitative investing has been a major factor in James Simons' net worth. His innovative use of statistical and mathematical techniques has allowed him to identify undervalued assets and generate high returns for his investors.

Hedge fund performance

The connection between hedge fund performance and James Simons' net worth is direct and significant. The high returns generated by Renaissance Technologies, the hedge fund founded by Simons, have been a major factor in his net worth of $28 billion.

Renaissance Technologies has been able to generate high returns by identifying mispriced assets and taking advantage of market inefficiencies. This has been possible due to Simons' innovative use of quantitative investing techniques, which involve using statistical and mathematical models to analyze vast amounts of data and identify undervalued assets.

The success of Renaissance Technologies has been a major contributor to James Simons' net worth. The fund's consistent outperformance of the market has allowed Simons to accumulate a vast fortune. In addition, the fund's high returns have attracted a large number of investors, which has further increased Simons' net worth.

Overall, the connection between hedge fund performance and James Simons' net worth is clear and significant. The high returns generated by Renaissance Technologies have been a major factor in Simons' net worth of $28 billion.

Philanthropy

James Simons' net worth of $28 billion has enabled him to make significant philanthropic contributions to various causes, including education, scientific research, and medical research. His philanthropy has had a major impact on the world, supporting important initiatives and advancing knowledge in these fields.

- Education: Simons has donated hundreds of millions of dollars to support education, both in the United States and abroad. He has established scholarship programs, funded new schools, and supported educational research. Simons believes that education is the key to a better future, and his philanthropy reflects his commitment to investing in the next generation.

- Scientific research: Simons has also been a major supporter of scientific research. He has donated hundreds of millions of dollars to fund research in a variety of fields, including mathematics, physics, and neuroscience. Simons believes that scientific research is essential for advancing our understanding of the world and solving some of the world's most pressing problems.

- Medical research: Simons has also donated significant sums to medical research. He has funded research into a variety of diseases, including cancer, Alzheimer's disease, and Parkinson's disease. Simons believes that medical research is essential for improving the lives of people around the world.

Overall, James Simons' philanthropy is a reflection of his commitment to making a positive impact on the world. His donations have supported important causes in education, scientific research, and medical research, and have helped to advance knowledge and improve the lives of people around the world.

Mathematical models

James Simons' innovative use of mathematical models and data analysis has been a major factor in his financial success. Simons is a pioneer in the field of quantitative investing, which uses statistical and mathematical techniques to identify undervalued assets. This approach has allowed Renaissance Technologies, the hedge fund founded by Simons, to consistently outperform the market since its inception in 1982.

Simons' mathematical models have given Renaissance Technologies an edge in the financial markets. The fund's models are able to identify patterns and trends in the market that are invisible to the naked eye. This allows Renaissance Technologies to make that are more likely to be profitable.

The success of Renaissance Technologies has made James Simons one of the richest people in the world. His net worth is estimated to be $28 billion. Simons' success is a testament to the power of mathematical models and data analysis in the financial world.

The use of mathematical models and data analysis is becoming increasingly important in the financial world. As the markets become more complex, it is becoming more difficult to make investment decisions based on traditional methods. Mathematical models and data analysis can provide investors with a valuable edge in the market.

Market inefficiencies

James Simons' hedge fund, Renaissance Technologies, has been able to generate high returns by identifying and exploiting market inefficiencies. This is a major factor in Simons' net worth of $28 billion.

Market inefficiencies are deviations from the efficient market hypothesis, which states that all available information is reflected in the prices of assets. In other words, market inefficiencies are opportunities to buy assets for less than their intrinsic value or to sell assets for more than their intrinsic value.

Renaissance Technologies uses a variety of quantitative techniques to identify and exploit market inefficiencies. These techniques include statistical analysis, machine learning, and artificial intelligence. By identifying and exploiting market inefficiencies, Renaissance Technologies has been able to generate high returns for its investors.

The ability to identify and exploit market inefficiencies is a key skill for any investor. By understanding how markets work and by using the right tools and techniques, investors can improve their chances of generating high returns.

Wealth management

James Simons' success as a wealth manager is a major component of his net worth of $28 billion. Simons has been able to grow his wealth through a combination of investment strategies, including quantitative investing and hedge fund management.

Simons' quantitative investing strategies have been particularly successful. He is a pioneer in the field of quantitative investing, which uses statistical and mathematical techniques to identify undervalued assets. This approach has allowed Renaissance Technologies, the hedge fund founded by Simons, to consistently outperform the market since its inception in 1982.

In addition to his quantitative investing strategies, Simons has also been successful in managing his own wealth. He has made a number of astute investments over the years, including investments in real estate, private equity, and venture capital. Simons has also been able to grow his wealth through compound interest. By reinvesting his earnings, Simons has been able to grow his net worth exponentially.

The practical significance of understanding the connection between wealth management and James Simons' net worth is that it highlights the importance of sound investment strategies. By making wise investment decisions, individuals can grow their wealth over time. Simons' success is a testament to the power of sound investment strategies and the importance of wealth management.

Financial success

James Simons' financial success is an important component of his net worth of $28 billion. Simons has achieved great success in the financial world, primarily through his work as a hedge fund manager. He is the founder and former CEO of Renaissance Technologies, a hedge fund that has consistently outperformed the market since its inception in 1982.

Simons' success in the financial world is due to a number of factors, including his innovative use of quantitative investing techniques. Quantitative investing involves using statistical and mathematical models to identify undervalued assets. Simons and his team at Renaissance Technologies have developed sophisticated algorithms and models that allow them to identify these undervalued assets and generate high returns for their investors.

The practical significance of understanding the connection between financial success and James Simons' net worth is that it highlights the importance of making sound investment decisions. By making wise investments, individuals can grow their wealth over time. Simons' success is a testament to the power of sound investment strategies and the importance of financial success in building wealth.

Global impact

James Simons' philanthropy has had a significant impact on various global causes, contributing to his overall net worth of $28 billion. Through his generous donations, Simons has supported advancements in education, scientific research, and medical care worldwide.

- Education: Simons' philanthropic efforts in education aim to provide access to quality education for students from diverse backgrounds. He has established scholarship programs, funded new schools, and supported educational research initiatives. These investments empower individuals with knowledge and skills, fostering a more educated and equitable society.

- Scientific research: Simons recognizes the importance of scientific research in advancing human understanding and addressing global challenges. His donations have supported fundamental research in mathematics, physics, and neuroscience. By funding cutting-edge research, Simons contributes to the expansion of scientific knowledge and the development of innovative technologies.

- Medical research: Simons' philanthropy extends to the field of medical research, with a focus on understanding and treating diseases. He has funded research into cancer, Alzheimer's disease, and Parkinson's disease. These investments support the development of new treatments and therapies, ultimately improving the lives of countless individuals worldwide.

The global impact of James Simons' philanthropy highlights the power of wealth in making a positive difference. His generous donations have supported education, scientific research, and medical care, contributing to advancements that benefit society as a whole. Understanding the connection between Simons' philanthropy and his net worth underscores the importance of using wealth for the greater good and the lasting impact it can have on the world.

FAQs on James Simons Net Worth

This section provides answers to frequently asked questions (FAQs) regarding James Simons' net worth, aiming to clarify common concerns and misconceptions.

Question 1: What is the estimated net worth of James Simons?

As of 2023, James Simons' net worth is estimated to be around $28 billion, making him one of the wealthiest individuals in the world.

Question 2: How did James Simons accumulate his wealth?

Simons' wealth primarily stems from his success in the financial industry. He is the founder and former CEO of Renaissance Technologies, a hedge fund that has consistently outperformed the market since its inception in 1982.

Question 3: What is the significance of quantitative investing in Simons' wealth?

Quantitative investing, which involves using mathematical and statistical models to identify undervalued assets, has been a key driver of Simons' financial success. Renaissance Technologies employs sophisticated algorithms and models to identify such assets, generating high returns for its investors.

Question 4: How has Simons used his wealth to make a global impact?

Simons is a noted philanthropist who has donated hundreds of millions of dollars to various causes, including education, scientific research, and medical research. His philanthropy has supported important initiatives and advancements in these fields, making a significant impact on a global scale.

Question 5: What factors have contributed to the growth of Simons' net worth?

Simons' net worth has grown over time due to several factors, including the consistent performance of Renaissance Technologies, his astute investment decisions, and his effective wealth management strategies.

Question 6: What lessons can be learned from James Simons' financial success?

Simons' success underscores the importance of sound investment strategies, risk management, and a deep understanding of financial markets. His innovative approach to quantitative investing has revolutionized the industry and serves as an example of how mathematical models can be effectively applied in the financial realm.

In conclusion, James Simons' net worth is a testament to his financial acumen, innovative investment strategies, and philanthropic endeavors. His success highlights the potential for wealth to be used as a force for positive change in the world.

Transition to the next article section: Exploring the Investment Strategies of James Simons

Tips on Building Wealth from James Simons' Net Worth

Analyzing the strategies and principles behind James Simons' net worth can provide valuable insights for individuals seeking to build wealth. Here are key tips derived from his success:

Tip 1: Embrace Quantitative Investing

Simons' success is largely attributed to his pioneering approach to quantitative investing. This involves using mathematical and statistical models to identify undervalued assets. By leveraging data and analysis, investors can potentially enhance their decision-making and identify opportunities that may not be apparent through traditional methods.

Tip 2: Seek Market Inefficiencies

Simons' hedge fund, Renaissance Technologies, has consistently outperformed the market by exploiting inefficiencies. These inefficiencies arise when market prices deviate from the intrinsic value of assets. By identifying and capitalizing on these inefficiencies, investors can potentially generate superior returns.

Tip 3: Emphasize Risk Management

Simons places great importance on risk management. Effective risk management involves assessing potential risks and taking measures to mitigate them. By managing risk prudently, investors can protect their capital and increase the likelihood of achieving long-term financial goals.

Tip 4: Invest for the Long Term

Building wealth often requires a long-term perspective. Simons has demonstrated the power of compound interest over time. By investing regularly and allowing earnings to accumulate, investors can potentially grow their wealth significantly.

Tip 5: Seek Continuous Education

Simons' success is also a testament to his commitment to continuous learning. staying abreast of market trends, investment strategies, and financial news is essential for making informed investment decisions.

Summary

Building wealth requires a combination of knowledge, strategy, and discipline. By incorporating the principles derived from James Simons' net worth, investors can potentially improve their financial decision-making and increase their chances of achieving long-term financial success.

Conclusion

James Simons' net worth is a testament to his innovative investment strategies, quantitative modeling expertise, and philanthropic endeavors. His success highlights the potential for wealth to be used as a force for positive change in the world.

The key takeaways from examining Simons' net worth include the importance of embracing quantitative investing, seeking market inefficiencies, emphasizing risk management, investing for the long term, and committing to continuous education. By incorporating these principles into their financial decision-making, investors can potentially enhance their chances of building wealth and achieving financial success.

Unveiling Rebecca Zamolo's Net Worth: Uncover The Secrets To Her Financial Success

Discover The Secrets Behind Morimoto Shintaro's Success In NPB

Unveiling Gustavo Petro's Net Worth: Discoveries And Insights